Warren Buffett: The Oracle of Omaha

Buffett at the 2015 SelectUSA Investment Summit

|

|

| Born | Warren Edward Buffett August 30, 1930 (age 93) Omaha, Nebraska, U.S. |

|---|---|

| Education | University of Pennsylvania University of Nebraska (BS) Columbia University (MS) |

| Occupation | Businessman, investor, philanthropist |

| Title | Chairman and CEO of Berkshire Hathaway |

| Political party | Democratic |

| Spouse(s) | Susan Thompson (m. 1952; died 2004) Astrid Menks (m. 2006) |

| Children | 3, including Susan and Howard |

| Awards | Presidential Medal of Freedom (2011) |

| Net worth | ~$114 billion (October 2023) |

Warren Edward Buffett (/ˈbʌfɪt/ BUF-it; born August 30, 1930) is an American businessman, investor, and philanthropist who currently serves as the chairman and CEO of Berkshire Hathaway. As a result of his immense investment success, Buffett is one of the best-known fundamental investors in the world. As of October 2023, he had a net worth of $114 billion, making him the seventh-richest person in the world.

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowBuffett was born in Omaha, Nebraska. The son of US Congressman Howard Buffett, he developed an interest in business and investing in his youth. He was admitted to the University of Pennsylvania at the age of 16 and eventually transferred to and graduated from the University of Nebraska at 19. He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham. He attended the New York Institute of Finance to focus his economics background and soon after began various business partnerships, including one with Graham. After meeting Charlie Munger, Buffett created the Buffett Partnership. His firm would eventually acquire a textile manufacturing firm called Berkshire Hathaway and assume its name to create a diversified holding company.

Buffett has been the chairman and largest shareholder of Berkshire Hathaway since 1970. He is noted for his adherence to value investing, and his personal frugality despite his immense wealth. His 2006 pledge to give away 99 percent of his wealth to philanthropic causes, primarily via the Bill & Melinda Gates Foundation, was valued at approximately $30.7 billion as of 2022. In 2009, Buffett, along with Bill Gates, founded The Giving Pledge, whereby billionaires pledge to give away at least half of their fortunes.

Early Life

Childhood

|

Howard Buffett, Warren's father

|

|

| Born | August 13, 1903 Omaha, Nebraska, U.S. |

|---|---|

| Died | April 30, 1964 (aged 60) Omaha, Nebraska, U.S. |

| Occupation | Businessman, politician |

| Political party | Republican |

| Spouse | Leila Stahl |

| Children | Warren Buffett, Doris Buffett, Roberta Buffett |

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska, to Congressman Howard Buffett and his wife Leila (née Stahl). He was the second of three children and the only son. His father Howard was a fourth-generation Nebraskan who operated a stock brokerage and would later serve four terms as a U.S. Congressman.

Buffett displayed an extraordinary aptitude for both money and business at a very early age. Friends and acquaintances have said that the young boy was a mathematical prodigy who could add large columns of numbers in his head, a talent he occasionally demonstrated in his later years.[1]

At the age of six, Buffett purchased six-packs of Coca-Cola from his grandfather's grocery store for twenty-five cents and resold each bottle for a nickel, pocketing a five-cent profit.[2] While other children his age were playing games, Buffett was making money. At eleven, he bought his first stock: three shares of Cities Service Preferred at $38 per share for both himself and his older sister, Doris. The stock quickly dropped to just over $27 per share but rebounded to $40. Warren sold his shares at this price, netting a profit of $5 per share. However, the stock later skyrocketed to nearly $200 per share, teaching him the lesson of patience in investing.[3]

As a teenager, Buffett worked at his grandfather's grocery store and generated income from several entrepreneurial ventures including delivering newspapers, selling golf balls and stamps, and detailing cars. By the time he finished high school, Buffett had accumulated the equivalent of $53,000 in today's dollars from his various business ventures.[4]

Education

Buffett attended Woodrow Wilson High School in Washington, D.C., where his father served in Congress, and was a standout student with a particular gift for mathematics. His yearbook picture caption read: "likes math; a future stockbroker."[5]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowDespite his father's urging to attend college close to home, Buffett was adamant about attending the Wharton School of the University of Pennsylvania, which he entered at the age of 16 in 1947. He studied there for two years before transferring to the University of Nebraska–Lincoln, where he graduated at age 19 with a Bachelor of Science in business administration.[6]

After being rejected by Harvard Business School, Buffett discovered that Benjamin Graham, whose book The Intelligent Investor Buffett greatly admired, was teaching at Columbia Business School. He was accepted there and earned a Master of Science in economics from Columbia in 1951. At Columbia, Graham became Buffett's mentor and greatly influenced his investment philosophy.[7]

After graduating from Columbia, Buffett also attended the New York Institute of Finance, where he focused on economics and quickly began his business career.

Early Business Ventures

After graduating, Buffett wanted to work on Wall Street but was persuaded by his father to return to Omaha. He began his career as an investment salesman at Buffett-Falk & Co., his father's brokerage firm, from 1951 to 1954.[9]

In 1954, Benjamin Graham offered Buffett a job at his partnership, Graham-Newman Corp., with a starting salary of $12,000 per year (approximately $120,000 today). Buffett moved to White Plains, New York, with his family to work as a securities analyst. During this time, he worked closely with Graham and honed his investment techniques.[10]

When Graham retired in 1956, Buffett returned to Omaha and started his first investment partnership, Buffett Associates, Ltd., with $105,100 of capital, $100 of which was his own. By the end of the year, he was managing around $300,000 in capital.[11] Over the next several years, he established several additional partnerships which were eventually consolidated into one entity.

Investment Career

Buffett Partnership

From 1956 to 1969, Buffett managed the Buffett Partnership, Ltd., which achieved an average annual return of 29.5%, significantly outperforming the Dow Jones Industrial Average's 7.4% during the same period.[12] The partnership began with seven limited partners who together contributed $105,000, while Buffett, as general partner, started with $100. The limited partners received 6% annually on their investment and 75% of the profits above this threshold, while Buffett received the remaining 25%.[13]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowBuffett employed three categories of investments in the partnership: Generals (undervalued securities for the long term), Workouts (special situations like mergers and acquisitions), and Controls (acquiring controlling interest in companies).[14]

By 1962, the partnership had grown to over $7 million in capital, with more than 90 partners. That year, Buffett merged all his partnerships into a single entity and opened an office in Kiewit Plaza in Omaha, where Berkshire Hathaway's headquarters remains today.[15]

The partnership continued its remarkable performance throughout the 1960s, despite challenging market conditions. However, by 1969, Buffett found it increasingly difficult to identify undervalued companies that met his investment criteria. He decided to liquidate the partnership, telling his partners that he was "unable to find any bargains in the current market."[16]

Berkshire Hathaway

|

|

|

| Type | Public |

|---|---|

| Traded as | NYSE: BRK.A, BRK.B DJIA component S&P 100 component S&P 500 component |

| Industry | Conglomerate |

| Founded | 1839 (as Valley Falls Company) 1888 (as Berkshire Cotton Manufacturing) 1955 (as Berkshire Hathaway through merger) |

| Founder | Oliver Chace |

| Headquarters | Omaha, Nebraska, U.S. |

| Key people | Warren Buffett (Chairman & CEO) Charlie Munger (Vice Chairman) Greg Abel (Vice Chairman) |

Berkshire Hathaway originated as a textile manufacturing company established in 1839 by Oliver Chace. After several mergers and name changes, it became known as Berkshire Hathaway in 1955 when Hathaway Manufacturing merged with Berkshire Fine Spinning Associates.[17]

Buffett began buying shares of Berkshire Hathaway in 1962, attracted by its apparent cheapness relative to its working capital. He eventually acquired enough shares to take control of the company in 1965. Though the textile business continued to struggle, Buffett used Berkshire as a vehicle to invest in other businesses.[18]

In 1967, Berkshire purchased National Indemnity Company, its first insurance venture, marking a turning point for the company. The insurance business provided Buffett with "float" – money collected as premiums that could be invested before claims were paid out. This provided a continuous source of capital for investments.[19]

Over the following decades, Buffett gradually shifted Berkshire's focus away from textiles and toward insurance and other investments. The textile operations were finally closed in 1985.[20]

Under Buffett's leadership, Berkshire Hathaway evolved into a massive conglomerate owning dozens of companies across various industries, including insurance (GEICO, General Re), utilities (MidAmerican Energy), railroad (BNSF Railway), and consumer goods (Dairy Queen, Fruit of the Loom, See's Candies). The company also maintains a substantial investment portfolio with major stakes in companies like Apple, Bank of America, Coca-Cola, and American Express.[21]

One of Berkshire's most notable acquisitions was the purchase of GEICO in 1996. Buffett had first invested in GEICO in 1951 after visiting the company on a Saturday and finding a janitor who let him into the office of Lorimer Davidson, then vice president. Davidson spent hours explaining the insurance business to the young Buffett, who became convinced of GEICO's competitive advantages.[22]

Another significant acquisition was BNSF Railway, purchased in 2010 for $26.3 billion, which was Berkshire's largest acquisition at the time.[24] In 2015, Berkshire acquired Precision Castparts Corp. for $32.1 billion, surpassing the BNSF purchase as the largest in Berkshire's history.[25]

Berkshire's Class A shares are among the highest-priced shares on the New York Stock Exchange, with a single share trading at hundreds of thousands of dollars. This high price was intentional, as Buffett wanted to attract long-term investors rather than speculators.[26] In 1996, Berkshire issued Class B shares at 1/30th of the value of Class A shares (later adjusted to 1/1500th) to make ownership more accessible to small investors.[27]

Investment Philosophy

Warren Buffett's investment philosophy is deeply rooted in the value investing approach taught by Benjamin Graham, which involves seeking securities that are priced inexpensively relative to their intrinsic value. However, Buffett evolved beyond Graham's strict focus on quantitative factors to incorporate qualitative considerations about business quality and management.[28]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowKey elements of Buffett's investment philosophy include:

- Economic Moats: Buffett looks for companies with sustainable competitive advantages or "economic moats" that protect them from competition. These can include brand strength, cost advantages, network effects, or regulatory protections.[29]

- Margin of Safety: Following Graham's principle, Buffett insists on buying at a significant discount to intrinsic value to allow for errors in estimation or unforeseen problems.[30]

- Circle of Competence: Buffett emphasizes investing only in businesses that he understands well, famously stating, "Never invest in a business you cannot understand."[31]

- Long-Term Perspective: Buffett takes a long-term approach to investing, often holding stocks for decades. His favorite holding period is "forever."[32]

- Management Quality: He places great importance on the quality and integrity of a company's management, looking for leaders who are rational, candid, and shareholder-oriented.[33]

- Focus on Return on Equity: Rather than focusing on earnings per share, Buffett evaluates performance based on return on equity, preferring companies that generate high returns without excessive debt.[34]

Buffett is also known for his avoidance of technology stocks for many years, stating that he didn't understand them well enough to invest. However, he eventually broke this rule with investments in IBM, Apple, and other tech companies once he determined they had developed sustainable competitive advantages.[35]

Another distinctive aspect of Buffett's approach is his concentration of investments. Unlike modern portfolio theorists who advocate for diversification, Buffett believes in putting large sums into his best ideas, famously saying, "Diversification is protection against ignorance. It makes little sense if you know what you are doing."[36]

Buffett's annual letters to Berkshire Hathaway shareholders are widely read for their investment wisdom and business insights, as well as their wit and clarity in explaining complex financial concepts.[37]

Personal Life

Family

Warren Buffett married Susan Thompson in 1952. The couple had three children: Susan Alice, Howard Graham, and Peter. Though they separated in 1977 when Susan moved to San Francisco to pursue a singing career, they remained married until her death in 2004.[38]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowDuring their separation, Buffett developed a relationship with Astrid Menks, a Latvian-born waitress whom Susan had introduced to Buffett. After Susan's death, Buffett married Menks on his 76th birthday in 2006.[39]

Buffett's children have pursued diverse careers. Susan Alice Buffett is a philanthropist and chair of the Susan Thompson Buffett Foundation. Howard Graham Buffett serves on Berkshire's board and is a farmer and philanthropist. Peter Buffett is a musician and composer.[40]

Despite his immense wealth, Buffett has stated that he plans to give most of his fortune to philanthropy rather than leaving it to his children, believing that "a very rich person should leave his kids enough to do anything but not enough to do nothing."[41]

Lifestyle

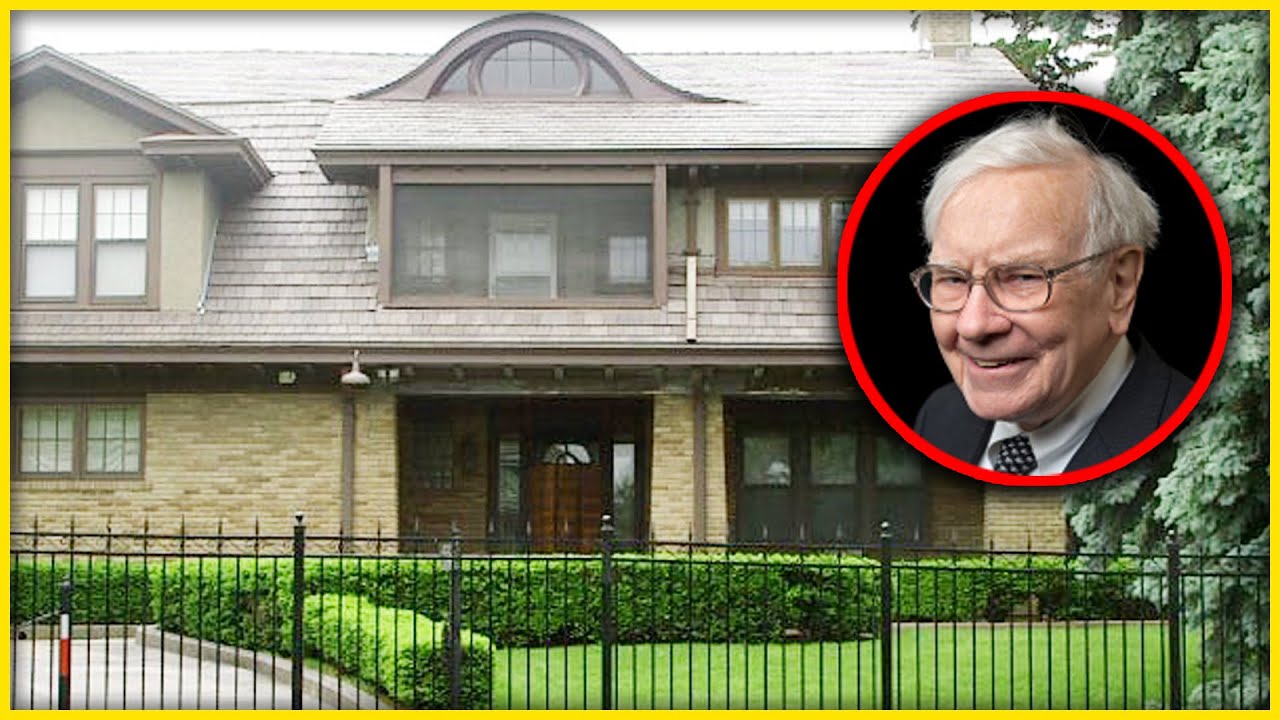

Despite being one of the wealthiest people in the world, Buffett is known for his personal frugality and unpretentious lifestyle. He continues to live in the same house in Omaha that he purchased in 1958 for $31,500 (approximately $290,000 in today's dollars).[42]

Buffett's home in Omaha, purchased in 1958

|

|

| Address | 5505 Farnam Street Omaha, Nebraska |

|---|---|

| Purchase price | $31,500 (1958) |

| Estimated value | $1.2 million (2023) |

Buffett is known for his simple tastes in food, often eating McDonald's for breakfast and drinking Coca-Cola (a company he has invested in heavily). He does not carry a cell phone or have a computer at his desk, though he has acknowledged the latter might be a mistake.[43]

His transportation is similarly modest. For years, he drove a Cadillac, upgrading only when forced to by his daughter. In 2014, he replaced his 2006 Cadillac DTS with a Cadillac XTS.[44] He also owns a private jet, which he nicknamed "The Indefensible" due to its extravagance relative to his typically frugal habits.[45]

Buffett is an avid bridge player, often playing online several hours a week. He has stated that bridge is "the best exercise there is for the mind."[46] He frequently partners with Bill Gates in bridge tournaments.

Political Views

Buffett is a lifelong Democrat, despite his father being a Republican congressman. He has supported numerous Democratic candidates and causes, while advocating for higher taxes on the wealthy.[47]

In 2011, Buffett published an op-ed in The New York Times titled "Stop Coddling the Super-Rich," in which he argued that the wealthy should pay higher taxes, noting that his effective tax rate was lower than that of his secretary. This argument became known as the "Buffett Rule."[48]

Buffett has been critical of the estate tax repeal efforts, calling it a "dynastic welfare program for the super-rich."[49] He has also advocated for universal health care and expressed concerns about income inequality.[50]

Despite his political leanings, Buffett maintains friendships with politicians and business leaders across the political spectrum and has advised both Democratic and Republican presidents.[51]

Philanthropy

Warren Buffett is one of the most significant philanthropists in history. In 2006, he announced that he would gradually give away 85% of his Berkshire Hathaway stock to five foundations, with the majority (83%) going to the Bill & Melinda Gates Foundation.[52]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowHis total pledge was valued at approximately $31 billion at the time, making it the largest charitable donation in history. The gifts are made in annual installments of Berkshire Hathaway Class B shares.[53]

Buffett's philanthropic philosophy is distinctive. Rather than establishing a foundation with his name, he chose to give the majority of his wealth to the Gates Foundation, believing it to be the organization best equipped to address global challenges. He has stated, "I know what I want to do, and it makes sense to get it into the hands of people who are going to do it better."[54]

The remaining portions of his pledge were directed to foundations established by his children: the Susan Thompson Buffett Foundation, the Howard G. Buffett Foundation, and the NoVo Foundation (run by Peter Buffett and his wife Jennifer).[55]

The Giving Pledge

In 2009, Buffett, along with Bill and Melinda Gates, launched The Giving Pledge, a commitment by the world's wealthiest individuals and families to dedicate the majority of their wealth to philanthropy.[56]

The pledge is a moral commitment rather than a legal contract, and signatories are encouraged to publicly state their intention through a letter explaining their decision to give. As of 2023, over 240 billionaires from 28 countries have signed the pledge.[57]

Buffett's own pledge letter states: "I've worked in an economy that rewards someone who saves the lives of others on a battlefield with a medal, rewards a great teacher with thank-you notes from parents, but rewards those who can detect the mispricing of securities with sums reaching into the billions. In short, fate's distribution of long straws is wildly capricious. The reaction of my family and me to our good fortune is not guilt, but rather gratitude. Were we to use more than 1% of my claim checks on ourselves, we would not add nor even happiness. So the remaining 99% can be used to benefit others."[58]

Bill & Melinda Gates Foundation

Buffett's contributions to the Bill & Melinda Gates Foundation have significantly expanded its capacity to address global health, development, and education issues. His annual gifts typically represent about 5% of the foundation's total assets each year.[59]

Oracle of Omaha: Warren Buffett

Author: Sam Gardner

Genre: Biography

Language: English

Pages: 217

Formats: Kindle, Paperback, Hardcover

Buy NowBuffett serves as a trustee of the foundation but has taken a largely hands-off approach, trusting the Gateses and their team to allocate the resources effectively. He has stated, "I'm not an expert on malaria, and I'm not an expert on education... But I am an expert on allocating capital. So I allocated capital to them."[60]

His contributions have helped fund initiatives to eradicate polio, reduce malaria deaths, improve agricultural productivity in developing countries, and enhance educational opportunities in the United States.[61]

Public Image

Oracle of Omaha

Buffett's investment success and wisdom have earned him the nickname "Oracle of Omaha," reflecting both his hometown and his seemingly prescient investment decisions.[62] His annual shareholder meetings, often called "Woodstock for Capitalists," attract tens of thousands of attendees from around the world.[63]

Buffett is known for his folksy wisdom, self-deprecating humor, and ability to explain complex financial concepts in simple terms. His quotes and aphorisms are widely circulated and have been compiled in several books.[64]

Despite his fame and wealth, Buffett maintains an approachable public persona. He gives numerous interviews each year and is known for his accessibility to students and investors.[65]

In Popular Culture

Buffett has appeared in several films and television shows, often playing himself. These include appearances in The Office, All My Children, and the documentary I.O.U.S.A.[66]

In 2017, he was portrayed by Ed Asner in the HBO film Too Big to Fail, which depicted the 2008 financial crisis.[67] He has also been the subject of several documentaries, including Becoming Warren Buffett and Warren Buffett: The World's Greatest Money Maker.[68]

Buffett's influence extends to the culinary world with the "Warren Buffett Diet" – his reported habit of consuming five cans of Coca-Cola per day and eating junk food – though nutritionists do not recommend this approach.[69]

Criticism and Controversies

Despite his generally positive public image, Buffett has faced criticism on several fronts:

Tax Avoidance: While advocating for higher taxes on the wealthy, Buffett has been criticized for utilizing tax avoidance strategies. Berkshire Hathaway has engaged in sophisticated tax planning, and the company has faced scrutiny for its tax practices.[70]

2008 Financial Crisis: During the 2008 financial crisis, Buffett invested billions in companies like Goldman Sachs and General Electric, receiving favorable terms that critics argued were not available to ordinary investors. His role as both an advisor to the government and a beneficiary of bailout policies drew criticism.[71]

Climate Change: Environmental activists have criticized Buffett for Berkshire Hathaway's continued investments in fossil fuel companies and utilities that rely on coal. Though he has expressed support for renewable energy, critics argue he has not moved quickly enough to address climate concerns.[72]

Succession Planning: For years, investors expressed concerns about the lack of a clear succession plan at Berkshire Hathaway. Though the company has since identified potential successors, the advanced age of both Buffett and Charlie Munger led to questions about the company's future.[73]

Kraft-Heinz Investment: Berkshire's investment in Kraft Heinz Company, which struggled significantly and wrote down $15 billion in assets in 2019, was seen by some as a rare misstep for Buffett.[74]

Bibliography

Several books have been written about Warren Buffett, including:

- The Essays of Warren Buffett: Lessons for Corporate America by Lawrence Cunningham (1997)

- Buffett: The Making of an American Capitalist by Roger Lowenstein (1995)

- The Snowball: Warren Buffett and the Business of Life by Alice Schroeder (2008)

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor by Jeremy Miller (2016)

- Of Permanent Value: The Story of Warren Buffett by Andrew Kilpatrick (multiple editions since 1994)

Buffett himself has not authored any books, but his annual letters to Berkshire Hathaway shareholders are compiled and studied as valuable resources on investing and business management.[75]

See Also

- Benjamin Graham

- Value investing

- Charlie Munger

- Berkshire Hathaway

- The Giving Pledge

- List of wealthiest Americans in history

- List of investors

References

- Schroeder, A. (2008). The Snowball: Warren Buffett and the Business of Life. Bantam Books. p. 30.

- Lowenstein, R. (1995). Buffett: The Making of an American Capitalist. Random House. p. 12.

- Buffett, Warren E. (1988). Berkshire Hathaway Chairman's Letters. Berkshire Hathaway.

- Schroeder (2008), p. 58.

- Kilpatrick, A. (2020). Of Permanent Value: The Story of Warren Buffett. AKPE. p. 45.

- Schroeder (2008), p. 89.

- Lowenstein (1995), p. 35.

- Hagstrom, R. G. (1997). The Warren Buffett Portfolio: Mastering the Power of the Focus Investment Strategy. Wiley. p. 67.

- Schroeder (2008), p. 145.

- Lowenstein (1995), p. 56.

- Schroeder (2008), p. 192.

- Buffett Partnership Ltd. (1969). Partnership Letter.

- Lowenstein (1995), p. 71.

- Buffett Partnership Ltd. (1962). Partnership Letter.

- Schroeder (2008), p. 285.

- Buffett Partnership Ltd. (1969). Partnership Letter.

- Berkshire Hathaway Inc. (2022). History of Berkshire Hathaway.

- Lowenstein (1995), p. 89.

- Schroeder (2008), p. 412.

- Buffett, Warren E. (1985). Berkshire Hathaway Chairman's Letter.

- Berkshire Hathaway Inc. (2022). 2021 Annual Report.

- Buffett, Warren E. (1996). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (1989). Berkshire Hathaway Chairman's Letter.

- Berkshire Hathaway Inc. (2010). Press Release: Berkshire Hathaway to Acquire Burlington Northern Santa Fe.

- Berkshire Hathaway Inc. (2015). Press Release: Berkshire Hathaway to Acquire Precision Castparts Corp..

- Schroeder (2008), p. 512.

- Buffett, Warren E. (1996). Berkshire Hathaway Chairman's Letter.

- Graham, B. (1949). The Intelligent Investor. Harper & Brothers.

- Buffett, Warren E. (2007). Berkshire Hathaway Chairman's Letter.

- Graham (1949), p. 95.

- Buffett, Warren E. (1996). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (1988). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (1989). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (1979). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (2011). Berkshire Hathaway Chairman's Letter.

- Buffett, Warren E. (1993). Berkshire Hathaway Chairman's Letter.

- Cunningham, L. A. (1997). The Essays of Warren Buffett: Lessons for Corporate America. Cardozo Law Review.

- Schroeder (2008), p. 367.

- Schroeder (2008), p. 621.

- Schroeder (2008), p. 712.

- Buffett, Warren E. (1986). Berkshire Hathaway Chairman's Letter.

- Schroeder (2008), p. 298.

- CNBC. (2013). Warren Buffett: I Don't Have a Computer on My Desk.

- Forbes. (2014). Warren Buffett Upgrades to a New Cadillac.

- Schroeder (2008), p. 615.

- Fortune. (2006). Warren Buffett: The King of Cotton.

- New York Times. (2007). Buffett to Help Clinton Campaign.

- Buffett, Warren E. (2011). "Stop Coddling the Super-Rich". New York Times.

- Buffett, Warren E. (2003). Berkshire Hathaway Chairman's Letter.

- CNN. (2017). Warren Buffett: Health Care Costs are a Tapeworm on American Competitiveness.

- Schroeder (2008), p. 723.

- Buffett, Warren E. (2006). Press Release: Warren Buffett to Give Bulk of Fortune to Gates Foundation.

- Gates Foundation. (2022). Annual Report.

- Fortune. (2006). Why Warren Buffett is Giving Away His Fortune.

- Buffett, Warren E. (2006). Press Release.

- The Giving Pledge. (2009). About the Giving Pledge.

- The Giving Pledge. (2023). Current Signatories.

- Buffett, Warren E. (2010). The Giving Pledge Letter.

- Gates Foundation. (2022). Financials.

- CNBC. (2010). Warren Buffett on Philanthropy.

- Gates Foundation. (2022). Impact Report.

- Forbes. (2008). The Oracle of Omaha.

- Berkshire Hathaway Inc. (2022). Annual Meeting Information.

- Hagstrom, R. G. (2005). The Warren Buffett Way. Wiley.

- Schroeder (2008), p. 815.

- IMDb. (2023). Warren Buffett.

- HBO. (2011). Too Big to Fail.

- HBO. (2017). Becoming Warren Buffett.

- Fortune. (2015). Warren Buffett's Diet is Worse Than You Think.

- New York Times. (2011). Buffett's Tax Avoidance.

- Wall Street Journal. (2008). Buffett's Goldman Deal.

- The Guardian. (2021). Warren Buffett Criticized for Climate Change Inaction.

- Bloomberg. (2021). Berkshire's Succession Plan.

- Financial Times. (2019). Kraft Heinz Troubles.

- Cunningham, L. A. (1997). The Essays of Warren Buffett.

0 Comments